Simon Johnson continues his series of guest posts looking at the Australian and New Zealand carbon pricing schemes.

Simon Johnson continues his series of guest posts looking at the Australian and New Zealand carbon pricing schemes.

Finally I have got past the chartjunk and I have read the Report on the New Zealand Emissions Trading Scheme that Minister for Climate Change Issues Nick Smith released on 1 August 2011.

Perhaps the first point to make is that the NZ ETS has now been though a complete compliance period, the six months from 1 July 2010 (when energy and industry entered) to 31 December 2010, where both buyers (emitters) and sellers (foresters) of emissions units were in the NZ ETS market. So we should be able to make an assessment of how the NZ ETS is working.

The same underlying information, emissions units issued and surrendered in the 2010 year, has already been available from the “central bank” for emissions units – the NZ Emissions Unit Register, run by the Ministry of Economic Development. The Climate Change Response Act requires certain information on emissions trading to be disclosed annually. The Ministry for the Environment’s Report on the New Zealand Emissions Trading Scheme is really this same trading information with some, ugh, “100% Pure” photo shoot pictures, quite a few junk charts and several text-boxes.

The MfE report and Dr Smith’s press release received varied media coverage. The best reporting, with no junk charts, is Brian Fallow in the Herald.

Dr Smith’s narrative is that the NZ ETS is going well and Fairfax/Stuff repeated this angle, as did the National Business Review and even Reuters said the NZ ETS was working as intended. The Sydney Morning Herald reported that the NZ ETS had “performed to expectations.”

In terms of raw numbers, there 96 mandatory “participants” (emitters) in the NZ ETS at 31 December 2010, of which 76 are in the energy sector. There were 1,216 voluntary participants, of which 1,206 were in the forestry sector; forestry having entered the NZ ETS from 1 January 2008 mainly in terms of sequestering carbon in forest carbon sinks. In the six months from 1 July to 31 December 2010, 12.8 million NZUs were gifted to participants by “free allocation”; 9.4 million NZUs were transferred to foresters for forest carbon sequestration and 8.3 million units were surrendered to the Government (Surrender means to obtain units equivalent to a participant’s greenhouse gas (GHG) emissions and to transfer the units to the Government’s account at the NZ Emission Units Register).

We may then ask “So what?” in response to these raw facts. Well, lets think how the NZ ETS performed according to the expectations of someone who has written a book on the NZ ETS – the economist Geoff Bertram. In the book The Carbon Challenge: Bertram and co-author Simon Terry analysed the NZ ETS as a market for emission units/carbon credits which can be understood in terms of supply, demand and price.

The supply of NZUs into the market for the six months from 1 July to 31 December 2010 was 22 million NZUs, made up of 12.8 million NZUs gifted to companies by “free allocation” and 9.4 million NZUs transferred for forest carbon removals.

The demand from the market participants (the emitters) is the 8.3 million units surrendered in 2010. The NZ Emissions Unit Register report tells us that in 2010 there were 33.4 million tonnes of GHG emissions and the NZ ETS-liable emissions from 1 July 2010 were roughly half that, at 16.3 million tonnes. Remember Nick Smith’s 2-for-1 deal to surrender 1 unit for 2 tonnes of GHGs? That explains why only 8.3 million units were surrendered, when 16 million tonnes of GHGs were reported.

For me the critical issue here is that supply (22.2 million units) exceeded demand (8.3 million) by 13.9 million units (or by 267%). There were 13.9 million units left over after emitters satisfied their 2010 NZ ETS surrender obligations.

As we know from basic economics, when supply exceeds demand, there is downward pressure on the price. The MfE report and Dr Smith’s press release make no mention of movements in the NZ ETS carbon price. However, the reliable Westpac carbon update provided this chart which shows the price of NZUs consistently discounted against the price of Certified Emissions Reduction units in 2010-2011.

The left-over 2010 units have no expiry date and will carry forward to 2011. In 2011 and 2012, as well as starting with excess units, the 2010 template will be repeated for 12 months not six. More units will be allocated for free to industrial emitters and more units will be given to pre-1990 foresters as compensation, and to post-1989 foresters for carbon sequestration. The 2-for-1 deal carries on as well to 2013. These features are embedded into the structure of the NZ ETS and will ensure that for the rest of the Kyoto Protocol commitment period to 2012 the NZ ETS market will be over-allocated with NZUs which will trade at a discount to other internationally marketable Kyoto emissions units.

Geoff Bertram and Simon Terry made a number of predictions in The Carbon Challenge. Here’s one.

“In the New Zealand scheme, arbitrage between the NZU and the Kyoto currencies sets a ceiling on the carbon price, with no quantity limit. Local emissions volumes will change only insofar as the price of the Kyoto currencies constitutes an incentive to change behaviour; and NZUs will be used to cover liable emissions only insofar as they are a cheaper alternative to Kyoto currency units” (p 58).

My conclusion is that, contrary to Dr Smith’s narrative, the MfE report on the NZ ETS is completely consistent with Geoff Bertram’s prediction that the NZUs would be over-allocated, they would be priced at a discount to international units and as a consequence, the NZ ETS will not provide a sufficient price incentive to reduce GHG emissions in New Zealand.

NB 18 August 2011. I have added a screen shot of the Chief Executive’s Report on New Zealand Emissions Trading Scheme to clarify that it states that 12.77 million units were allocated to industry.

Of course you remembered that post1989 foresters are eligbile for emission units for forest growth since 1 January 2008, whereas the emitting sectors are only responsible for emissions since 1 July 2010.

And many of the allocations are compensation for impacts on asset values (land use for pre 1989 forests, quoto values for fishing).

And that allocation to pre 1990 forests are ‘two-offs’, with the initial allocation completed and another timed for after the end of 2012 – not every year.

It is true though that the government is giving out more units that it is receiving, at least until the end of 2012. Such is the nature of a ‘moderated’ ETS.

Thank you for usefully reminding me and Hot Topic readers of those important details of the NZ ETS. Your first point is a good point. I said 9.4 million units were transferred to foresters in the six months ending December 2010. That should have been in twelve months. As the Report on the NZ ETS says on page 11 “A total of 14.4 million carbon dioxide equivalent emissions have been claimed by post-1989 forestry, of which 9.2 million were claimed in calendar year 2010.”

Oh, and what makes you think the westpac carbon update is “reliable”? Surely they have a market interest themselves?

Would you like to share with us what you think Westpac’s “market interest” might be?

On reflection, when I wrote that, I was thinking ‘reliable’ in the sense that the Westpac Carbon update arrives ‘reliably’ in my inbox every month. Mind you, so does the Carbon Market Solutions newsletter arrives just as reliably and it enclosed a very similar chart of the price data.

Haha, “Geoff Bertram and Simon Terry made a number of predictions”, Id hardly call ‘predicting’ that the CER price will act as price ceiling a prediction. Its logical and obvious.

As has been pointed out, you are comparing the supply of units from 2008 to Dec 31st 2010 to the demand from July 2010 to Dec 31st 2010. But also the fact you can bank is a key factor. Obviously before July 2010 there was no ‘demand’, as you would measure it, but NZUs still traded (see your graph for example). So demand is more than just current demand, its all future demand.

Are the allocations you are comparing your demand to related to production of eligible activities for the period July 2010 to December 2011 (ie 18 months)?

What is your conclusion (the NZ ETS will not provide a sufficient price incentive to reduce GHG emissions in New Zealand) based on? I don’t see any link to your analysis.

If I didn’t know you better, I might have assumed you are criticising The Carbon Challenge by Bertram & Terry for applying basic economics to the market created by the NZ ETS.

If the economics of the NZ carbon price being capped at a discount to the international carbon price is such basic and obvious economics, why wasn’t there some economic analysis in Nick Smith’s report? Why didn’t the media reporting include some basic economics analysis?

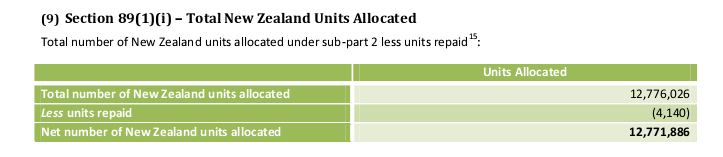

The allocations I treat as being ‘supply’ are not for any part of the 2011 year. The number of NZUs allocated for free is not clearly stated in “The Report on The NZ ETS”. On page 16, there is a pie chart of free allocations by activity that is calculated as percents. So it doesn’t give actual numbers of NZUs or the total NZUs allocated. However, from the Ministry of Economic Development Chief Executives report, the total number of NZUs allocated by free gifting between 1 July 2010 to 31 December 2011 is 12,776,026.

As for a bit more on the relevance of price, that’s going to be another post.

Regards

Surely most of the allocations are for forestry sequestration, which are not ‘supply’ at all seeing they will have to be surrendered on tree harvest. They are not ‘for free’.

How on earth did you reach an assumption that there have been 12m units allocated to industry?

At the top of the conclusion page (19) it states that allocation to industry will be around 3.5m units. Compared with ‘actual reported’ emissions of 16.3m units, I think the market is reasonably underallocated, which is why the NZU price is closely tracking the CER price.

You need to download and read The Chief Executive’s S89 Report from https://www.app.eur.govt.nz/eats/nz/Docs/Section_89_CE_Reporting2011.pdf. There is now a image from that report in the body of the post.

As I said, that is the source of the 12.77 million allocation of units.