Cross-posted from Coal Action Network Aotearoa

Last week was a bad week for coal mines on the West Coast.

Early in the week Solid Energy announced 24 workers would lose their jobs from the Stockton mine, and by the end of the week Bathurst announced that it is putting the Denniston mine on hold, laying off 12 workers – terrible news for those workers and their families.

At the heart of this is the same issue that sent Solid Energy under: plummeting coking coal prices – a price that has continued to fall, and was again cited as the reason for Solid’s new layoffs.

Over on the Denniston Plateau, Bathurst’s woes have stemmed, in the first instance, from the long-signalled closure of the Holcim plant in Westport, its biggest client. Bathurst has had to seek domestic buyers for its high grade coking coal, because of the low international price.

Bathurst has managed to keep Denniston’s head above water because of Holcim. It has kept the rest of its operations afloat due to other domestic customers like Fonterra. No doubt has it hopes pinned on Fonterra’s plans to continue to expand its coal-fired milk drying operations, such as the one at Studholme, near Waimate – plans that must now be in jeopardy, given its financial state. Fonterra is now the second largest user of coal in the country.

Buller District Mayor Garry Howard tried to explain the Stockton layoffs, saying that Solid had to show the company was in profit before the mine goes onto the international market in a couple of months.

Perhaps he needs to look around, firstly over the ditch to Australia, where Anglo American is getting out of both Australia and the coal industry altogether, racking up huge losses in a $5.6 billion write-down. Whether it can actually sell its coking coal mines remains to be seen – as many commentators are saying, it’s a buyer’s market.

The international coal industry is on its knees, especially in the US. Bankruptcies all over the place: the biggest being Arch Coal. Others, like Alpha Resources, have filed for bankruptcy protection. The world’s largest coal company, Peabody Energy, is teetering on the brink.

Yet here in NZ, the Government, mining lobby group Straterra, Mayor Garry Howard and even Labour Leader Andrew Little have all made reassuring words about how the price of coking coal will bounce back, how everyone will need steel, yada yada yada.

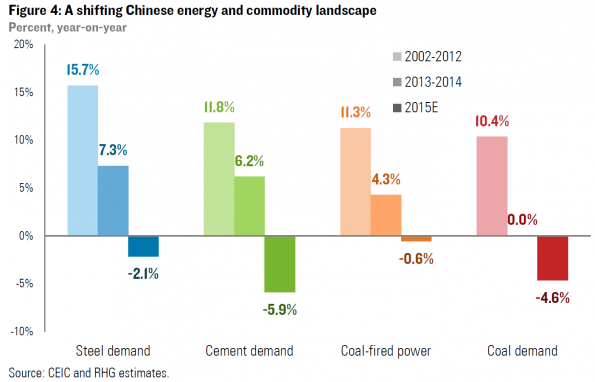

It’s actually the hard coking coal price that lies at the heart of the US coal industry’s collapse. And that is driven by a massive downturn in China’s economy, and its use of steel – a downturn that doesn’t look like turning round any time soon.

Early figures (Jan-Feb) released by the Chinese Government over the weekend show steel use has fallen another 6% year on year.

So why do we need more coal mines?

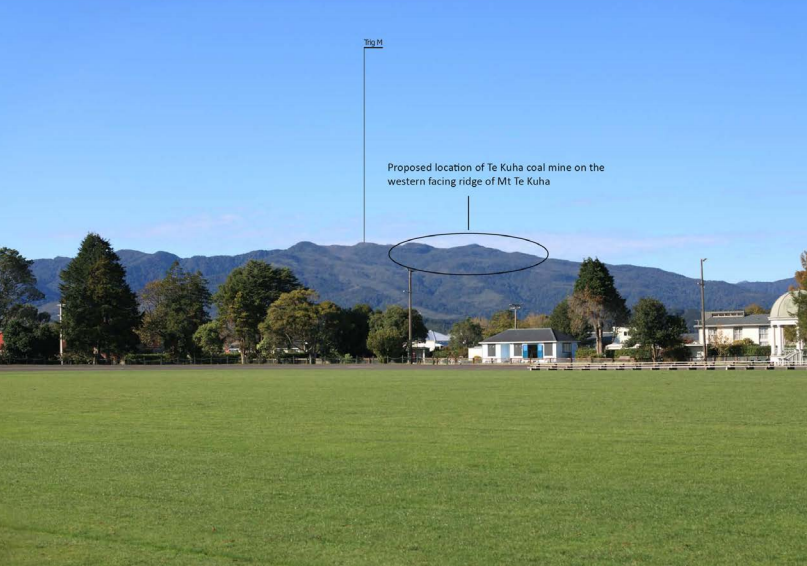

While all these coal layoffs were being announced last week, and the coking coal price continued to slide, I was writing CANA’s submission to the Department of Conservation to oppose an access agreement for a brand new coal mine on the West Coast.

This 109ha opencast mine would be slap bang in the middle of the Westport Water Conservation Area, and touches on the Mt Rochfort Conservation Area, home to the Great Spotted Kiwi, rare geckos – a landscape already designated by DOC as a “Naturally Uncommon Ecosystem.” It’s one of those rare landscapes that it’s the job of the Minister of Conservation to protect (Read the DOC significance report here).

You’ll be able to see this massive blot on the landscape from the lower Buller Gorge, and from downtown Westport (see photo from the DOC submission) – not so great for the Coast’s other main source of income: tourism.

You’ll be able to see this massive blot on the landscape from the lower Buller Gorge, and from downtown Westport (see photo from the DOC submission) – not so great for the Coast’s other main source of income: tourism.

And up on the North Taranaki Coast there’s another open cast coal mine application underway – Mokau South. My colleague Tim Jones has written about it here (submissions are now closed).

The Government has re-written the Crown Minerals Act to make sure the “net economic benefits” of any proposal have to be taken into account when considering any application for a new mine.

Will the various regional councils be able to see through their coal-dusted spectacles and realise that New Zealand doesn’t need any more coal mines? That the coal industry is on its knees, and that the mines we already have can’t find markets, either at home or internationally?

Will they look at the Crown Minerals Act in a different light and discover there will be no “net economic benefits” of new mines, just economic losses to accompany the disastrous environmental destruction and greenhouse gas emissions that result from coal mining?

Bathurst Resources have only mined 50,000 tonnes of coal from the Denniston Mine. That they’ve only destroyed 26ha of the planned 200ha of the mine footprint is a relief. The mine that the company pledged would employ hundreds has turned out to be another false hope, another white elephant.

For anyone to consider opening a new coal mine in Aotearoa in 2016 is just nuts.

We say: keep the coal in the hole. Save our precious environment, and stop that coal from ending up in the sky.

Exactly.

And with an average global temperature surging to over 1.5 degrees above pre-industrial levels last month the need for urgent action by governments world wide is even more clear.

And who wants to add coals to the fire now…..

https://www.theguardian.com/science/2016/mar/14/february-breaks-global-temperature-records-by-shocking-amount

One must feel sorry for the denier bunch, the pausists and the coming cooling callers. Reality is just not playing out for them.

February’s temperatures are indeed astonishing. The climate sceptics should get the message. But next year could be a colder year, and then the sceptics will start their chanting “global warming has stopped”. Its like human reasoning is been totally destroyed by these people.

The coal mine thing. We are told by John Key that the ETS is the mechanism we use to combat climate change. Yet this system leads to more coal companies opening, and nobody in the government bothers to ask whether this actually makes any sense.

The ETS isn’t strong enough to put companies off the emissions – and the coal miner won’t have to pay anything. Also, the RMA has been amended several times (and now tested in the Supreme Court) and councils are NOT ALLOWED to take climate change into account when considering applications for new mines.

NZ’s ETS is simply a crock and has been almost from its inception, and was trashed permanently by National in 2009. It needs to be taken out into the the back paddock and put down, and a creditable Carbon Tax put in its place and the mined or pumped or imported Carbon taxed at source or on entry into the country; and taxed heavily. The monies raised reinvested in alternative energies, public transport, subsidies to encourage the change over to alternative energies, and initial compensation for those unable to afford it.

Heavens, looks like Bennett’s going to scrap the two-for-one deal under the ETS! That’ll set cats amongst pigeons http://www.scoop.co.nz/stories/BU1603/S00553/big-carbon-emitters-to-lose-ets-subsidy-bennett.htm

When is the unanswered question though. And wow! the NZ price for a tonne of Carbon is $11.00!

These people just don’t get it do they?

So National will look like they actually care while continuing to do as little as possible. That has been their modus operandi for their time in Government.

These people just don’t get it do they?

I thought this was supposed to be market driven. Anyway the Scoop article states:

I’m sure the street parties will be beginning across the country at the prospect of increased cost of living.

Andy you miss the point here: a higher price on carbon is supposed to drive the companies to work to reduce emissions. Everyone in NZ, including you – and the government and media, seem to assume that people just pay and keep on emitting. But the less you emit, the less you pay.

It’s like increasing the tax on tobacco Andy – eventually even the most addicted will give it up. At the same time with taxing tobacco you can reinvest that money in health.

My point is that the article refers to “Big Polluters”, conjuring up images of big smokestacks, when the article implies (correctly) that everyone will be affected, so in that sense the article or press release is a little misleading.

I understand the purpose of the carbon tax, but unless there is full supply chain accounting of carbon on all products, then it becomes another consumption tax, like GST. It is very hard for a consumer to determine that the supermarket product used x amounts of “carbon” during production and delivery.

So, the question arises, if you want to tax people for consumption, even if this revenue is used to drive innovation in so-called low carbon technology, why not just increase GST?

The answer is fairly self-evident, given the subterfuge seen in the Scoop article alone.

I don’t entirely agree Andy. If there is a tax on carbon it will hit certain producers like fossil fuel companies for example. There could also potentially be a tax at the pump hitting consumers. (If we had that).

People don’t need to know exactly what products are affected as the price signal alone will push change.

However obviously there could be some list of what products are affected by the tax, or those most affected.

So therefore its not the same as an increase in gst and there is no reason to increase gst.

There was an interesting article in the Guardian which reported that the British Office of Statistics showed that the tonnage of goods consumed by the average Brit dropped from 15 tonnes in 2001 to 10 tonnes in 2013. The consumer goods we buy are getting lighter and do not consume as much energy as they used to. This may have something to do with the big drop in raw material demand.

On the other hand Bob – the annual emissions of CO2 last year was the greatest ever. We haven’t got GHG emissions under control by a long chalk.

dropping what is effectively a 50% subsidy should drive up the price of carbon. But it depends on whether we intend to keep allowing trade in hot air.

Even so Cindy, the NZUs come from forestry but what part of forestry – forests that are going to be cut down? If so that part of the trading is actually a con!

There’s a whole calculation about Kyoto forests – they have to mature to 35 years, after which they have, by simply growing for 35 years, locked up x amount of carbon, which can be traded. That they’re not being replaced is a bigger con.

I tend to agree with you, though, on all the forestry stuff – it’s a nightmare to police, and the whole AFOLU and LULUCF rort is just govts trying to avoid cutting emissions elsewhere.

But the Russian hot air is a much bigger rort than our forests.

There’s no doubt Westport is hurting with all the mine closures. My in-laws live there so I get this first hand. Reefton isn’t faring much better with closure of the Oceania gold mine, and Greymouth has been devastated by Pike River and other tragedies.

There’s some talk of building a road through the Wangapeka Track. Other than the environmental issues, I’m not convinced this will be the economic saviour of the coast.

They are even downsizing the Police in Westport, and centralising the service 1.5 hours away in Greymouth.

There is indeed no doubt about this Andy. This is what happens when you rely on a boom and bust commodity market for your main income, and it’s time there was a discussion about a sustainable strategy for the region: the type of Just Transition Coal Action Network called for in our Jobs After Coal report.

The West Coast Development Trust is sitting on a $92m fund given to it to help economic growth in the region after the Timberlands deal. As Jeanette Fitzsimons pointed out in this blog, getting money out of the Trust could be a new extractive industry for the region.

Heard on the radio this morning the West Coast dairy farmers could be among the worst hit by the current crisis. Last thing the region needs.

I have to wonder if the crash in dairy (another boom bust) cycle has just about disposed of NZ’s methane problem, for now. Heard on TVNZ yesterday, “Basically, you’ve got to go back to grassland farming – use what you can grow,” Mr Rolfe added