Simon Johnson guest posts on the mysterious number of emissions units allocated to emitters and a junk chart in the Ministry for the Environment’s Report on the New Zealand Emissions Trading Scheme.

You may recall that I previously commented on the low quality of data presentation in the Ministry for the Environment report Report on the New Zealand Emissions Trading Scheme.

My specific concern was that the report did not clearly indicate how many emission units (NZUs) had been allocated for free to emitters. Or, to say that again but slightly differently, what was the level of subsidy emitters had received in units?

Why am I going on about subsidies? Well, the point of an emissions trading scheme (ETS) is to place a carbon price on emissions. Free allocation of units to emitters unequivocally lessens the incentive effect of the carbon price. So free allocation is unequivocally a subsidy. The Australian Productivity Commission research report on carbon prices Carbon Emission Policies in Key Economies notes that all emissions policies involve either subsidies or prices and that imposing one measure implicitly imposes the other as well (page 49).

‘Carrots and sticks’

Despite the variety of policy instruments, all policies designed to promote lower greenhouse gas emissions essentially must either provide incentives to abate or disincentives to emit greenhouse gases, or both. Broadly speaking, all policies can be classified as those that:

1. encourage substitution of low-emissions technologies and products (for example, renewable electricity and biofuels) for higher-emissions technologies and products (such as coal-generated electricity and fossil fuels) — these policies essentially focus on the production or supply side

2 discourage consumption of products that generate emissions, either through price increases of those products and/or non-price induced decreases in demand for emissions-intensive products — these policies work through the demand side.

But whichever side of the market policies target, they will have implications for the other. Policies that effectively tax one commodity implicitly subsidise others. Effective subsidisation of a commodity implicitly taxes others. Put another way, to achieve their objective, policies that seek to reduce greenhouse gas emissions must alter relative prices to favour products that involve low emissions and to discourage products with the opposite characteristics.

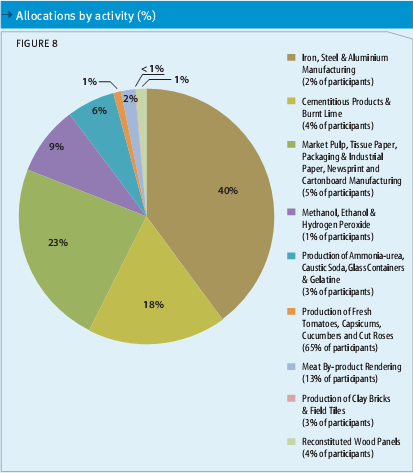

Now back to the junk chart. The Report on the New Zealand Emissions Trading Scheme included this pie chart, labelled Figure 8 on page 16 within the section titled ‘Sector Report Industry’.

In my previous post, I also noted that there appeared to be a gap of 3.4 million gifted NZUs, not disclosed in The Report on the NZ ETS, as the total number of NZUs allocated by free gifting between 1 July 2010 to 31 December 2011 is 12.7 million, according to the Ministry of Economic Development Chief Executives report.

So I wrote a letter to Nick Smith and politely asked for the actual data for Figure 8, the numbers of units allocated to industry, under the Official Information Act 1982.

The reply from Nick Smith arrived last week. It gave the data for Figure 8.

| Forecasted allocation of NZUs for period from 1 July 2010 to 31 December 2011 | ||

| Activity | percent | units |

| Iron Steel Aluminium Manufacturing | 40% | 2787045 |

| Market Pulp Tissue Paper Packaging & Industrial Paper Newsprint | 23% | 1644956 |

| Cementitious Products & Burnt Lime | 18% | 1227303 |

| Methanol Ethanol & Hydrogen Peroxide | 9% | 633992 |

| Ammonia-urea Caustic Soda Glass Containers and Gelatine | 6% | 424905 |

| Meat By-product Rendering | 2% | 122964 |

| Reconstituted Wood Panels | 1% | 94708 |

| Fresh Tomatoes Capsicums Cucumbers and Cut Roses | 1% | 67613 |

| Clay Bricks & Field Tiles | 0.10% | 7595 |

| Total | 100% | 7011081 |

However, the data is not for the same compliance period; 1 July to 31 December 2010; that the Report on the New Zealand Emissions Trading Scheme seems to report on. The allocations data is for the 18 month period to 31 December 2011. The data is not actual units allocated (obviously), it is a forecast. So we have inconsistent treatment of units surrendered (the demand) in Figure 5 and the units allocated to emitters (the supply) in Figure 8. It would not have been hard to correctly indicate that Figure 8 was a pie chart of forecast allocations, not actual. So why was this not done?

I am still left with the question of why the Ministry for the Environment is saying units allocated to 31 December 2011 will be 7 million, when the the Ministry of Economic Development Chief Executive’s report says that the total number of units allocated by free gifting between 1 July 2010 to 31 December 2011 is 12.7 million. I think the public deserve a better level of disclosure.

The only argument to justify this appalling ETS has been that it might be better than nothing and at least sends a signal that there is a price on carbon. Turns out, it is worse than nothing.

In 2011, for reasons future historians will no doubt puzzle over, we appear to have decided to embrace and encourage carbon intensive industries.

Reminds me of something. Ah, here it is:

“As the island became overpopulated and resources diminished, warriors known as matatoa gained more power and the Ancestor Cult ended, making way for the Bird Man Cult. ” http://en.wikipedia.org/wiki/Easter_Island

Interesting discussion re ‘subsidies’.

So any tax or other impost becomes part of the price and any untaxed or unlevied goods and services are subsidised?

eg my house is exempt from gst so it is being subsidised by all the punters who buy anything else except houses.

Well such experts as the World Bank, obviously think that these should be called “SUBSIDIES” and are set to recommend to the G20 Finance Ministers that they do away with the world wide $50 billion fossil fuel subsidies in an effort to combat AGW.

The draft report – leaked to the Guardian is here:

http://www.guardian.co.uk/environment/interactive/2011/sep/21/mobilising-climate-finance-report-g20

Australis,

I think that’s interpreting the idea a bit too widely. The Australian Productivity Commission was confining its comments to “policies designed to promote lower greenhouse gas emissions”.

To me the point they are making is that the issue is not whether a GHG reduction policy or a renewable energy promotion policy is or is not a ‘subsidy’, but whether the policy is equitable between sectors.

The whole point of an ETS or a GHG tax is so that the “tax or other impost becomes part of the price” of GHG emissions. And that the negative externality emissions of GHGs) becomes priced or dis-incentivised. The positive externalities (renewables, fuel switching, efficiency gains and sequestration) are implicitly incentivised (or ‘subsidised’).

If we accept this is the goal to achieve in the design of a GHG pricing policy, then exemptions for particular industries or delays or “two-for-one” deals or free allocation of units are all providing incentives (or ‘subsidies’ with a negative tone) that act in the wrong direction.

“I am still left with the question of why the Ministry for the Environment is saying units allocated to 31 December 2011 will be 7 million, when the the Ministry of Economic Development Chief Executive’s report says that the total number of units allocated by free gifting between 1 July 2010 to 31 December 2011 is 12.7 million. I think the public deserve a better level of disclosure.”

I’ve said this before. The MED CE reports on all allocations (industrial, fishing, forestry) whereas the industrial sector table in the MfE report is for allocations to …. industry.

And I think you’re being very naive about industrial allocation. The price signal is there and it will increase over time. It just isn’t at a level that will lead to social and economic losses and worse environmental outcomes when, say, NZ Steel shuts up and steel is imported into NZ from a 100% coal-burning plant in Indonesia who does not face any national emissions policies. Instead, a transition and small price encourages different investment decisions without the disastrous upheaval that would occur to South Auckland’s largest employer.

@password1,

1) The MED CE reports on all allocations (industrial, fishing, forestry) whereas the industrial sector table in the MfE report is for allocations to industry.

Well why isn’t this transparent rather than opaque?

2) The price signal is there and it will increase over time. Well it could hardly be any lower for NZ’s emissions-intensive emitters. Delayed entry, transitional two-for-one deals, and generous allocation all have the same effect, reducing the carbon price and therefore slowing the pace of substituting low carbon intensive technologies in place of highly carbon intensive technologies.

As for the carbon leakage argument. It is a fact of life that regulation and tax vary widely across the world. Yes there are lots of countries that have lower wages, lower or no environmental controls, no safety standards and no regulations. But we don’t accept that situation justifies exempting NZ Steel from those laws or justifies giving NZ Steel compensation.

It seems to me the same logic applies to carbon pricing.

That’s not a valid argument. I don’t see your ‘logic’. The lack of policies implemented in countries where competitors are based is precisely the reason for protecting NZ industries. Otherwise production shifts to those countries with net negative environmental, economic and social impacts globally.

If your ‘logic’ about the need for protection of NZ industries was correct, then NZ Steel would have shifted many years ago to any one of a large number of countries with lower wages, lower safety regulations, lower taxes, and less environmental regulations. Obviously NZ Steel has not moved, it has been chugging along fine in NZ in spite of its competitors being based in different jurisdictions with different levels of business regulation. Why would a carbon price be the regulatory “straw that broke the camels back”?

Because from a simple review of the financial statements for 2011 of Blue Scope Steel and the natural resource and energy report of NZ steel, the ETS at $25 would reduce the EBIT of steelmaking by 70%. That only counts the electricity, coal and gas consumed and includes ironsands sales revenues, so is likely to be an underestimate of the effect on the mill.

Oh yeah? In which year will that happen?